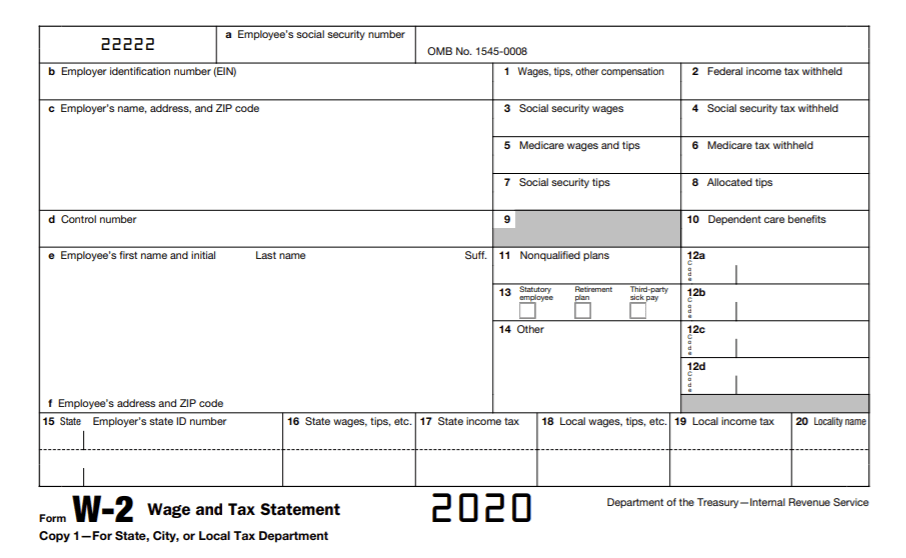

How to fill out Form W-2

You might have your Form W-2 responsibilities down to a science. Input employee information; send copies to employees; file the form with the SSA and state, city, or local tax department; and repeat the following year.

Or, you just might spend hours gathering employee information and trying to decode the Wage and Tax Statement.

Whether you complete Forms W-2 on your own, use payroll thepaystubs, or have a tax preparer, you should be semi-fluent in knowing how to fill out Form W-2.

As a generalization, Form W-2 boxes show identification, taxable wage, taxes withheld, and benefits information.

Boxes A-F are straightforward. They list identifying information about your business and employee. The numbered boxes, Boxes 1-20, can get a little more tricky.

If you want Form W-2 explained, dive into each box’s purpose below.

Box A: Employee’s Social Security number

Box A shows your employee’s Social Security number. Social Security numbers are nine digits that are formatted like XXX-XX-XXXX.

If your employee applied for a Social Security card and has not received it, don’t leave the box blank. Instead, write “Applied For” in Box A on the Social Security Administration copy. When the employee receives their SS card, you must issue a corrected W-2.

Box B: Employer Identification Number (EIN)

Box B shows your Employer Identification Number. EINs are nine-digit numbers structured like XX-XXXXXXX.

The number you enter in Box B is the same on every employee’s Form W-2. The IRS and SSA identify your business through your unique EIN.

Do not use your personal Social Security number on Forms W-2. If you do not have an Employer Identification Number, apply for an EIN before filing Form W-2. Then, mark “Applied For” in Box B.

Box C: Employer’s name, address, and ZIP code

Box C further identifies your business by listing your company’s name and address. Use your business’s legal address, even if it’s different than where your employees work.

Your employees may wonder whether the address is incorrect if it’s different than their work address. Verify your legal business address and ensure your employee it is accurate.

Box D: Control number

Box D might be blank, depending on whether your small business uses control numbers or not.

A control number identifies Forms W-2 so you can keep records of them internally. If you don’t use control numbers, leave this box blank.

Boxes E and F: Employee’s name, address, and ZIP code

Box E shows the employee’s first name, middle initial, and last name. Reference the employee’s SSN to enter their name correctly.

Enter the employee’s address in Box F.

Box 1: Wages, tips, other compensation

Box 1 reports an employee’s wages, tips, and other compensation. This is the amount you paid the employee during the year that is subject to federal income tax.

Payments not subject to federal income tax include pre-tax retirement plan contributions, health insurance premiums, and commuter benefits.

The wages you report in Box 1 might be higher or lower than other wages on Form W-2. This is not a mistake.

For example, an employee’s Box 1 wages can be lower than Box 3 wages. Some pre-tax benefits are exempt from federal income tax but not Social Security tax.

Important 2020 information: Did you provide paid sick and/or family leave to an employee under the Families First Coronavirus Response Act (FFCRA)? Include the amount of the paid leave here.

Box 2: Federal income tax withheld

Box 2 shows how much federal income tax you withheld from an employee’s wages and remitted to the IRS.

Federal income tax withholding is based on the employee’s taxable wages and filing status.

If your employee has a question about their refund amount or why they owe taxes, instruct them to Box 2. The IRS compares what the employee paid throughout the year in federal income taxes to their total liability.

Box 3: Social Security wages

Box 3 shows an employee’s total wages subject to Social Security tax. Do not include the amount of pre-tax deductions that are exempt from Social Security tax in Box 3.

The number in Box 3 should not be higher than the Social Security wage base. For 2020, the SS wage base is $137,700. For 2021, the wage base is $142,800.

If you must report Social Security tips (Box 7), the total of Boxes 3 and 7 must be less than $137,700 for 2020 (or $142,800 for 2021, to file in 2022).

Important 2020 information: If you provided FFCRA paid sick and/or family leave, include the amount in Box 3.

Box 4: Social Security tax withheld

Box 4 reports how much you withheld from an employee’s Social Security wages and tips.

The employee portion of Social Security tax is 6.2% of their wages, up to the SS wage base. Box 4 cannot be more than $8,537.40 ($137,700 X 6.2%) for 2020.

Important 2020 information: Did you defer an employee’s Social Security tax under the August 8, 2020 executive orders? Do NOT include the deferred Social Security tax in Box 4 if you did not withhold it. After withholding the deferred Social Security taxes from employee wages in 2021, you must file Form W-2c. For more information on the deferral and how it impacts W-2 reporting, check out our COVID-19 Resource Center.

Box 5: Medicare wages and tips

Enter how much the employee earned in Medicare wages and tips in Box 5.

An employee’s Box 5 value is generally the same as Box 4’s amount. However, there is no Medicare wage base. If the employee earned above the Social Security wage base, the number in Box 5 is higher than Box 3.

For example, the employee earned $150,000. The employee’s Social Security wages, (Box 3) should show $137,700 for 2020 while Box 5, Medicare wages and tips, displays $150,000.

Important 2020 information: If you paid FFCRA sick and/or family leave, include the amount in Box 5.

Box 6: Medicare tax withheld

Box 6 displays how much you withheld from an employee’s wages for Medicare tax. The employee share of Medicare tax is 1.45% of their wages.

The amount in Box 5 multiplied by the Medicare tax rate should equal Box 6. But if the employee earned above $200,000 (single), their tax liability should be greater.

If you paid an employee above $200,000 (single), you should have also withheld the additional Medicare tax rate of 0.9% from their wages above $200,000.

Box 7: Social Security tips

If your employee earned tips and reported them, enter the amount in Box 7. Also, include these tip amounts in Boxes 1 and 5.

Again, the total of Boxes 7 and 3 should not be more than $137,700 for 2020 (or $142,800 for 2021).

Box 8: Allocated tips

Report the tips you allocated to your employee in Box 8, if applicable. Allocated tips are amounts that you designate to tipped employees. Not all employers have to allocate tips to their employees.

Do not include the amount in Box 8 in Boxes 1, 3, 5, or 7. Allocated tips are not included in taxable income on Form W-2. Employees must use Form 4137 to calculate taxes on allocated tips.

Box 9: (Blank)

Leave Box 9 blank.

Box 10: Dependent care benefits

Did you give an employee dependent care benefits under a dependent care assistance program? If so, include the total amount in Box 10.

Dependent care benefits under $5,000 are nontaxable. Benefits over $5,000 are taxable. If you gave an employee more than $5,000, report the excess in Boxes 1, 3, and 5.

Box 11: Nonqualified plans

Box 11 reports employer distributions from a nonqualified deferred compensation plan to an employee.

Include the distribution amounts in Box 1, too.

Box 12: Codes

There are a number of W-2 Box 12 codes you may need to put on an employee’s Form W-2. If applicable, add the codes and amounts in Box 12.

These codes and values may lower the employee’s taxable wages.

Let’s say an employee elected to contribute $1,000 to a retirement plan. You would write D | 1,000.00 in Box 12.

Box 13: Checkboxes

Box 13 should not include values. Instead, mark the boxes that apply. There are three boxes within Box 13:

- Statutory employee

- Retirement plan

- Third-party sick pay

For example, if you entered Box 12 code D to show the employee’s retirement contributions, also check the ‘Retirement plan’ box.

Box 14: Other

Report amounts and descriptions in Box 14 such as vehicle lease payments, state disability insurance taxes withheld, and health insurance premiums deducted.

Important 2020 information: If you provided paid sick and/or family leave to an employee, report the amount with a description (e.g., “Sick leave wages subject to the $511 per day limit) in Box 14 OR on a separate statement.

Box 15: State | Employer’s state ID number

Like Box B, Box 15 identifies your business’s employer ID number. But, Box 15 is state-specific. Mark your state using the two-letter abbreviation. Then, include your state EIN.

Some states do not require reporting. Leave Box 15 blank if you have no reporting requirement with your state.

If you do not have an employer’s state ID number and need one, contact your state.

Box 16: State wages, tips, etc.

Box 16 shows an employee’s wages that are subject to state income tax. If the employee works in a state with no state income tax, leave Box 16 blank.

An employee’s Box 16 amount may differ from Box 1. This is not a mistake. Some wages are exempt from federal income tax and not state income tax.

Box 17: State income tax

Report how much you withheld for state income tax in Box 17. If you did not withhold state income tax, leave Box 17 blank.

Box 18: Local wages, tips, etc.

If your employee’s wages are subject to local income tax, include their total taxable wages in Box 18. Leave this box blank if the employee works in a locality with no income tax.

The amount you list in Box 18 might be different than Boxes 1 and 16.

Box 19: Local income tax

Report any local income tax withheld from the employee’s wages in Box 19. Leave this box blank if it is inapplicable.

Box 20: Locality name

Box 20 should show the name of the city or locality.

Leave a Reply